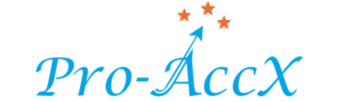

Rapid growth is a good problem to have until cash runs tight. For SaaS companies, MSPs, software developers, and IT consultancies, revenue can be recurring or project-based, costs can spike unexpectedly, and payment terms don’t always line up with supplier bills. That’s why robust cash flow forecasting is essential. It turns guesswork into visibility, and visibility into confident decisions.

In this guide, we explain how IT businesses can build reliable cash flow forecasts, which metrics matter at different stages of growth, and how specialist support from Pro AccX helps you stay ahead of risks while planning for scale.

What Is Cash Flow Forecasting and Why It Matters in IT

Cash flow forecasting projects how much money will move in and out of your business over a period (typically 13 weeks for short-term planning and 12+ months for strategic planning). It’s not just a finance exercise; it’s a decision tool that helps IT leaders time hires, plan product investments, manage debtors, and protect runway.

In fast-moving tech environments, forecasting matters because:

- Growth is lumpy: New contracts, churn, and expansion revenue make cash volatile.

- Costs are front-loaded: Development, tooling, and marketing spend often occur before revenue.

- Payment timing is critical: Supplier terms and subscription cash collection rarely align.

- Investor expectations: Credible forecasts build confidence during fundraising.

Short-Term vs Long-Term Forecasts

Most IT businesses benefit from a two-layer approach:

1) 13-Week (Operational) Forecast

A weekly view of receipts and payments—ideal for monitoring payroll, VAT, supplier runs, and late payers. This helps ensure you can meet obligations without dipping into overdrafts unnecessarily.

2) 12–18 Month (Strategic) Forecast

A monthly view aligned to your budget. It supports hiring plans, marketing ramp-up, product roadmaps, and fundraising milestones. For SaaS, it should incorporate pipeline assumptions (MRR, churn, expansion) and cash collection patterns.

Cash Flow Nuances by IT Business Model

SaaS & Subscription Platforms

- Cash drivers: New MRR, upgrades, downgrades, churn, billing cycles, payment method mix (card vs invoice).

- Risks: Overstating collection; ignoring failed payments/delinquency; neglecting annual prepay effects on deferred revenue and cash.

- Tip: Model cohort churn and delinquency separately from logo churn for more realistic cash collection.

Managed Service Providers (MSPs)

- Cash drivers: Retainers, project add-ons, vendor pass-through costs, hardware/software resale.

- Risks: Margin erosion when supplier invoices precede client payments; underestimating licence uplifts.

- Tip: Track client-level gross margin and set automated invoicing on contract anniversaries.

Software & App Developers / IT Consultancies

- Cash drivers: Milestone billing, timesheets, change requests, subcontractor costs.

- Risks: Scope creep without timely billing; long debtor days on enterprise projects.

- Tip: Build milestones into the forecast and model debtor days by client type.

Building a Practical Forecast (Step-by-Step)

- Start with opening cash: Bank balance(s) at the beginning of the period.

- Map predictable inflows: Subscriptions due, retainer invoices, scheduled milestones.

- Layer in variable inflows: Pipeline conversions, upsells, one-off projects—apply realistic win rates and timing.

- Add outflows: Payroll, PAYE/NIC, pensions, VAT, software, hosting, marketing, subcontractors, debt repayments, hardware, professional fees.

- Apply payment timing: Reflect actual collection patterns (DD/card vs invoice) and supplier terms (e.g., 7, 30, 45 days).

- Stress-test scenarios: Best case/base case/downside (e.g., +2% churn, –10% win-rate, +15 days debtor stretch).

- Update weekly/monthly: Replace estimates with actuals; track variance and refine assumptions.

Must-Track Metrics for Tech & SaaS

- MRR / ARR: Recurring revenue momentum.

- Churn & Net Revenue Retention: Health of the customer base and expansion success.

- Cash Burn & Runway: Months of cash left at current burn rate.

- CAC & LTV: Marketing efficiency and long-term profitability.

- Gross Margin: Especially for hosting, licences, and support-heavy models.

- Debtor Days (DSO): How quickly customers pay—key for MSPs and consultancies.

Common Forecasting Mistakes (and Fixes)

1) Confusing Revenue with Cash

Accrual revenue ≠ cash. Annual prepayments boost cash now but must be spread as revenue. Conversely, invoice-on-completion projects may inflate revenue while cash lags.

Fix: Build a separate cash schedule with actual collection timing by customer type and payment method.

2) Ignoring Churn and Delinquency

Assuming 100% retention or collection leads to optimistic forecasts.

Fix: Model churn, downgrades, failed payments, and reactivations explicitly.

3) Underestimating Tax and Compliance Outflows

VAT quarters, PAYE, and Corporation Tax can create cash crunches if not scheduled.

Fix: Calendar HMRC dates in the forecast; accrue monthly and ringfence cash.

4) Not Updating Forecasts with Actuals

Stale forecasts lose credibility.

Fix: Re-forecast monthly; track variances to improve assumptions.

5) No Scenario Planning

One plan is not a plan.

Fix: Build best/base/downside and agree triggers for cost controls or funding steps.

Tools & Systems That Make Forecasting Easier

- Cloud Accounting: Xero, QuickBooks, or FreeAgent for real-time data.

- Billing Platforms: Stripe, Chargebee, Recurly for subscription analytics.

- Forecasting Add-ons: Simple spreadsheets for early-stage, then specialised tools as you scale.

- Collections: Direct Debit and automated reminders to reduce debtor days.

The key is integration—so invoices, collections, and costs flow into one reliable view of cash.

How Pro AccX Helps IT Businesses Stay Ahead

At Pro AccX, we specialise in finance for IT and tech. Our management accounts and cash flow support give founders and finance leads the numbers they need—clean, current, and actionable.

- 13-week and 12–18 month forecasts built around your model (SaaS, MSP, projects).

- Monthly reporting packs with KPIs like MRR, churn, gross margin, DSO, CAC/LTV.

- VAT & HMRC scheduling to prevent surprise outflows, see VAT returns.

- Bookkeeping that scales with automations and clear coding, see bookkeeping services.

- Tax planning & CT600 integration so forecasts match real-world liabilities, see Corporation Tax.

We work on fixed monthly fees and operate remotely across the UK, so you get specialist insight without adding headcount.

Investor & Board-Ready Forecasts

Whether you’re raising Seed/Series A or reporting to a board, credibility matters. We produce clear, consistent forecasts and variance analyses that withstand scrutiny, with assumptions explained and linked to real operating data. That builds trust and speeds decisions.

Final Thoughts

Growth without cash visibility is risky. With a disciplined forecast, IT leaders can time hires, fund product development, navigate VAT quarters, and negotiate supplier terms from a position of strength. The best time to build your forecasting cadence was yesterday; the next best time is today.

Book Your Free Consultation

Want a forecast you can trust? Pro AccX builds cash flow models and management accounts designed for IT and SaaS. Book a free consultation and take control of your cash before growth takes control of you.